what is the corn market going to do

This is a presentation summary from the 2021 virtual Illinois Farm Economics Summit (IFES). A video of the webinar and PowerPoint Slides (PDF) are available hither .

Corn and soybean prices have shown remarkable resilience in 2021. During the 2020-21 marketing year, nearby futures prices peaked in May 2021 at over $7.fifty per bushel for corn and $16 per bushel for soybeans. This rally was acquired by a surge in US exports coupled with production shortfalls in major growing regions outside the US. Since that fourth dimension, prices for both crops have remained at historically high levels. As the calendar twelvemonth draws to a close, the nearby futures toll for corn remains nigh $half dozen per bushel and for soybeans about $13.

The profitability of corn and soybean production in 2022 will depend on continued forcefulness in output prices. Rising input costs, particularly for fertilizer, are squeezing projected margins. We consider two important drivers of corn and soybean prices in 2022. In the first commodity based on our IFES webinar, we discuss the state of 2021-22 marketing yr US corn and soybean exports. In this 2d article, nosotros talk over the prospects for United states of america crop acreage and product in 2022, another key driver of expectations for 2022 corn and soybean prices.

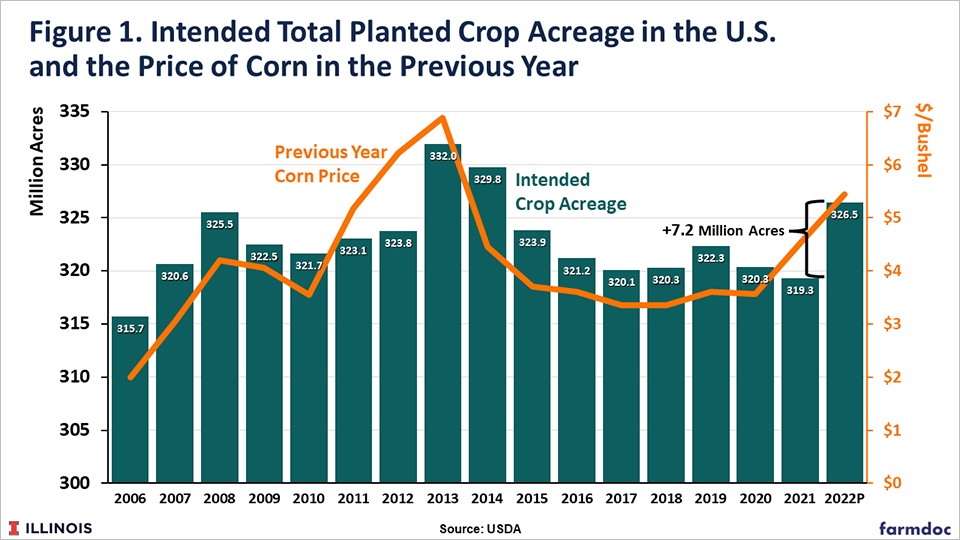

The starting point for because corn and soybean planted acreage for 2022 is the total size of planted acreage. Figure 1 below shows that at that place is more variation from year- to-twelvemonth in the size of the "acreage pie" than is commonly appreciated. Note that the bars in the nautical chart represent intended total planted crop acreage in the U.S. each twelvemonth from 2006-2021. This is the sum of full principal crop acreage, equally divers by the USDA, and prevented plant acreage. Since prevented constitute acres were intended to be planted, for our purposes hither we desire to sum what was planted (principal crop acres) with what did not end up getting planted (prevented plant acres) to get intended total crop acreage.

Total intended crop acreage increased during the ethanol nail years from 2006 through 2013, peaking at 332 1000000 acres in 2013. Afterward this elevation, acreage declined steadily to a depression of 319.three million in 2021. While there are a variety of factors that influence the level of total crop acreage, the information indicate that economic incentives play an important role. A unproblematic measure of that incentive is the marketing twelvemonth average cost of corn. While uncomplicated, corn does have the largest share of crop acreage in the U.S. Here, we plot the full intended crop acreage vs. the marketing year price of corn lagged by ane year in gild to reflect the market toll in the fourth dimension frame when farmers made acreage decisions for a given crop.

There is clearly a relationship between electric current total crop acreage and the previous year price of corn. Information technology is not exact by any means, but is helpful in predicting trends in total acreage. The WASDE forecast for the season average toll of corn for 2021/22 was $five.45 per bushel at the time of this writing. This is the cost that is relevant for projecting full acreage for 2022. Since the price of corn is then loftier, historically speaking, information technology suggests a sharp rebound in total crop acreage of around 7 million acres. This would put full acreage at 326.5 million in 2022, the highest level since 2014.

The projection of a leap in total intended crop acreage for 2022 is a crucial part of projecting corn and soybean planted acreage. Prices for nigh crops are currently loftier from a historical standpoint, so there is an incentive to plant more of many crops. The projected increase in Effigy 1 means that planted acreage can basically increase across the lath and crops will not have to "steal" acres from other crops in lodge to expand acreage.

With that context, we tin move on to projecting corn and soybean planted acreage for 2022. The steps involved are shown in Table one. The starting point here is the combined total of corn and soybean acreage, which has not varied much in recent years. This makes sense because corn and soybeans by and large "compete" for the same acres and the total of the two crops does not vary greatly from yr-to-year. Nosotros do forecast a small increment in combined corn and soybean acreage for 2022, in view of the increase in total ingather acreage availability and high prices for both crops. Our projection is 183 million acres, the highest in contempo years. We project one.5 meg prevented plant acres in 2022 for the ii crops, near the historical boilerplate, and this results in 181.v million combined planted acres for the two crops.

The split up between corn and soybeans for the 181.5 million acre forecast is a key source of uncertainty. As noted earlier, ascension input costs add together to this incertitude for 2022. The relationship between the new crop soybean/corn futures price ratio and the percentage of soybean planted acreage has provided helpful signals in the past. At the fourth dimension of this writing (early December 2021) the new ingather price ratio was around two.25, a level that favors corn and predicts a very low pct of soybean acres. We take a conservative approach in view of the rising in input costs and project soybean acreage at 47 percentage of combined corn and soybean acres. This results in forecasts of 97 meg intended acres of corn and 86 1000000 intended acres of soybeans. After adjusting for projected prevented plant acres, our concluding forecasts of corn and soybean planted acreage are 96.0 and 85.5 one thousand thousand acres, respectively, for 2022.

These acreage forecasts are not hugely unlike from actual planted acreage for corn and soybeans in 2021. Even so, the corn acreage forecast is well-above the forecasts of almost other analysts at the present time. It is oft argued that input toll increases, particularly for nitrogen fertilizer, dampen the incentives to expand corn acreage in 2022. Fourth dimension will tell if this truly comes to pass.

Source: https://farmdocdaily.illinois.edu/2022/01/ifes-2021-2022-market-outlook-for-corn-and-soybeans-part-ii-acreage.html

0 Response to "what is the corn market going to do"

Post a Comment